Tax Brackets 2024 Explained For Seniors. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Calls for increasing standard deduction to rs 60,000 or rs 70,000.

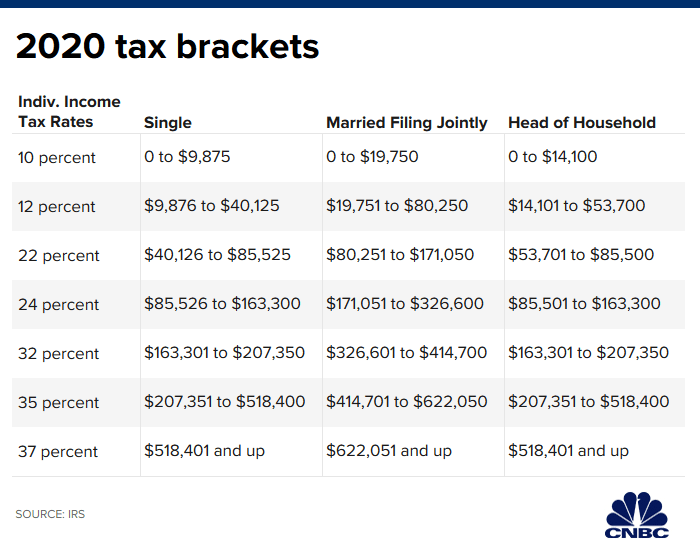

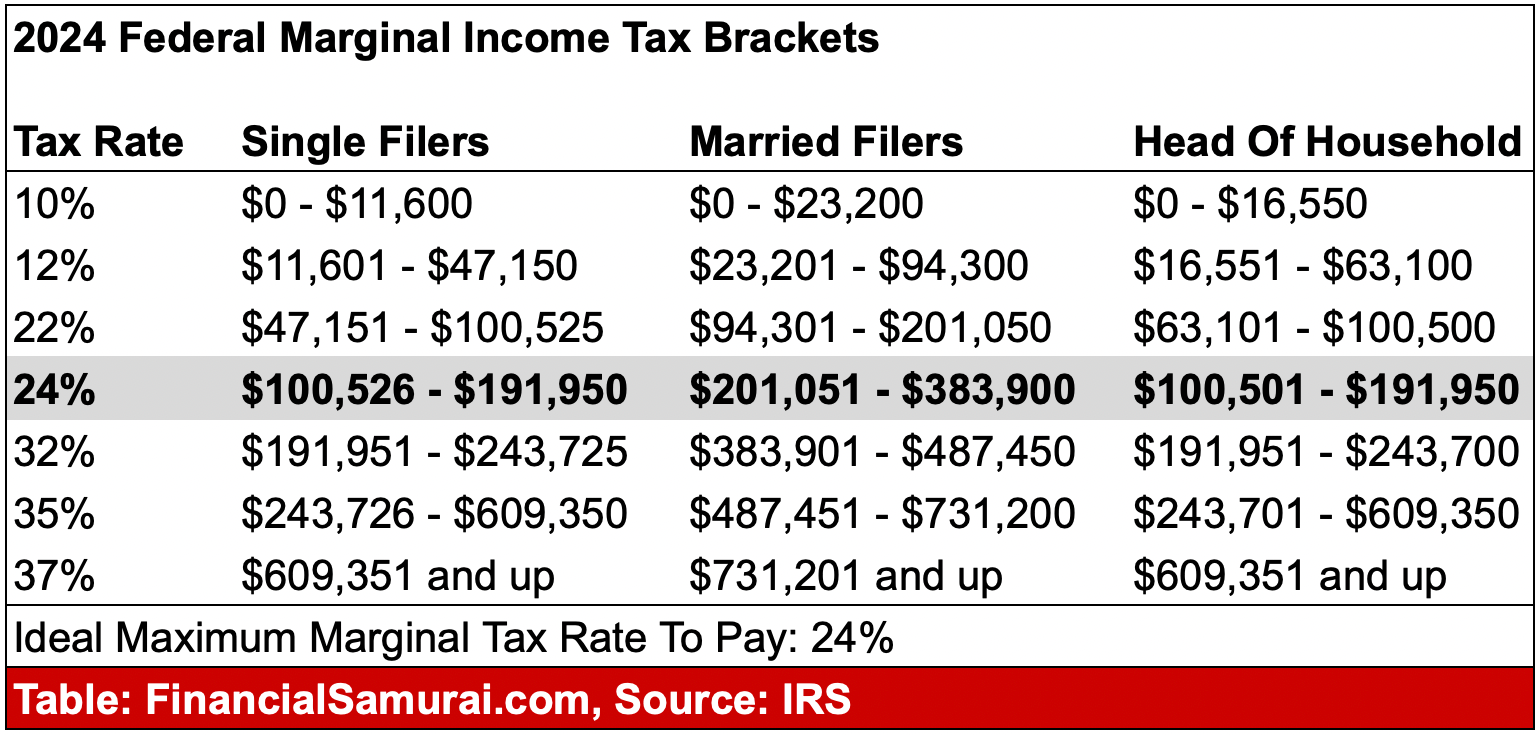

For tax year 2024, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

The Federal Income Tax Has Seven Tax Rates In 2024:

A super senior citizen is an individual resident who is 80 years or above, at any time during the.

For Tax Year 2024, Which Applies To Taxes Filed In 2025, There Are Seven Federal Tax Brackets With Income Tax Rates Of 10%, 12%, 22%, 24%, 32, 35%, And 37%.

If you start now, you can make plans to reduce your 2024 tax bill.

Tax Brackets 2024 Explained For Seniors Images References :

Source: vinnyqsusanetta.pages.dev

Source: vinnyqsusanetta.pages.dev

Tax Brackets 2024 Explained For Seniors Nicol Anabelle, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 2024 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2024 rose by 5.4% from 2023 (which is slightly lower than the 7.1%.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know, 2024 tax brackets (taxes due in april 2025) the 2024 tax year, and the return due in 2025, will continue with these seven federal tax brackets: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Source: sophiawcecile.pages.dev

Source: sophiawcecile.pages.dev

2024 Tax Brackets For Seniors Over 65 lishe hyacintha, Use the income tax estimator to work out your tax. Your bracket depends on your taxable income and filing status.

Source: theradishingreview.com

Source: theradishingreview.com

Tax Breaks for Seniors The Radishing Review, 2024 tax brackets (taxes due in april 2025) the 2024 tax year, and the return due in 2025, will continue with these seven federal tax brackets: The federal income tax has seven tax rates in 2024:

Source: www.moneywiseup.net

Source: www.moneywiseup.net

2024 Tax Brackets And The New Ideal Money Wiseup, For tax year 2024, which applies to taxes filed in 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Source: www.qfsc.com

Source: www.qfsc.com

IRS Announces New 2024 Tax Brackets Queen Financial Services, The new irs tax brackets for 2024 were released early last year. The highest earners fall into the 37% range,.

Source: www.youtube.com

Source: www.youtube.com

IRS Releases NEW Inflation Tax Brackets…What This Means For You in, Single filers will see an increase of $750 and joint filers will receive a $1,500 bump in their standard. Tax brackets 2024 explained for seniors nicol anabelle, if you’re a single taxpayer age 65 and older, you can add $1,850 to $13,850 standard deduction.

Source: taxfoundation.org

Source: taxfoundation.org

2024 Tax Brackets and Federal Tax Rates Tax Foundation, The highest earners fall into the 37% range,. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: cheryeqmarilyn.pages.dev

Source: cheryeqmarilyn.pages.dev

2024 Tax Rates And Brackets For Seniors Vevay Theadora, The new irs tax brackets for 2024 were released early last year. There are two slabs for the same — the old regime and the new regime.

Source: hestiabmyranda.pages.dev

Source: hestiabmyranda.pages.dev

Individual Tax Rates 2024 Ato Calla Corenda, The federal income tax has seven tax rates in 2024: The new irs tax brackets for 2024 were released early last year.

Your Bracket Depends On Your Taxable Income And Filing Status.

Use the income tax estimator to work out your tax.

Let’s Explore The Two Types Of Taxes That Individuals May Qualify For And.

The federal income tax has seven tax rates in 2024:

Posted in 2024